Market Review:

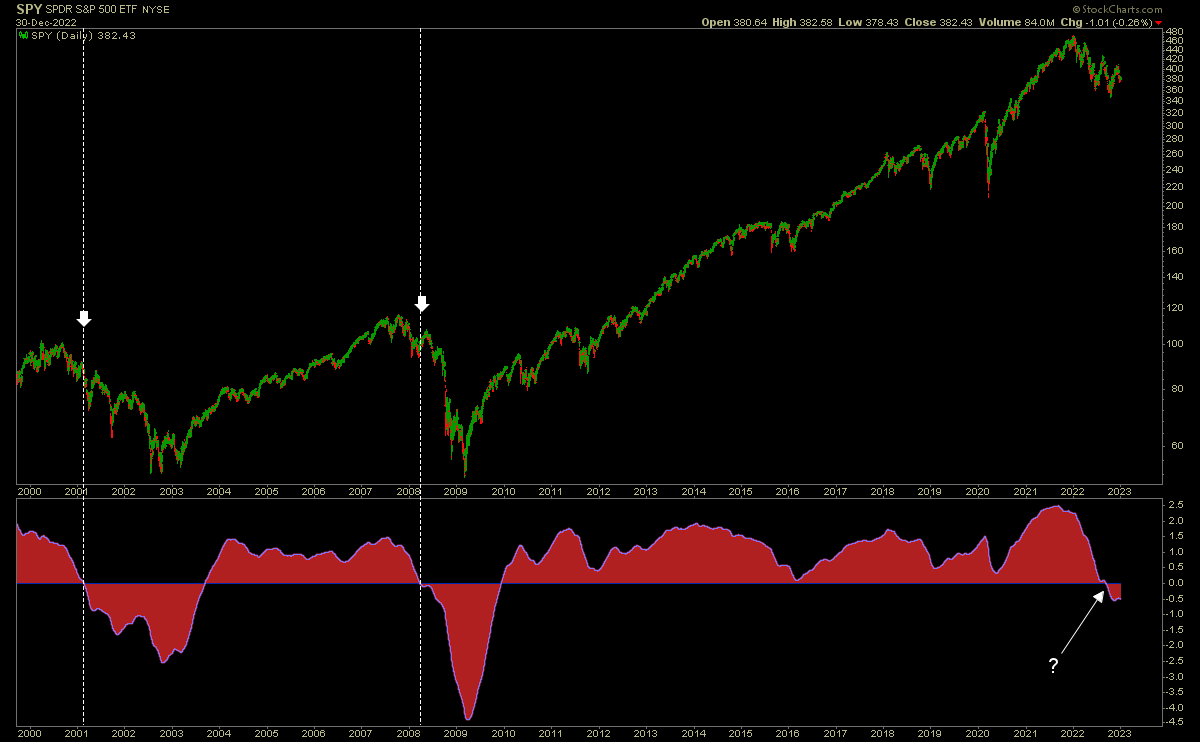

Going into the new year, every major equity index is in a downtrend. In particular, the S&P 500 remains entrenched in a bear market:

Using an ultra-longterm 200 & 250 moving average crossover, the red histogram partitions the market into bullish and bearish super-cycles. From this vantage point, this is the most significant downtrend since 2008.

No matter how you slice it, last year was replete with downtrends. The ARKK Innovation ETF spent 100% of 2022 in a long-term downtrend.

Every minute of price action that occurred to the right of the dashed vertical line took place in the context of a bear market. But that never deterred countless traders from fighting that trend tooth and nail all the way down.

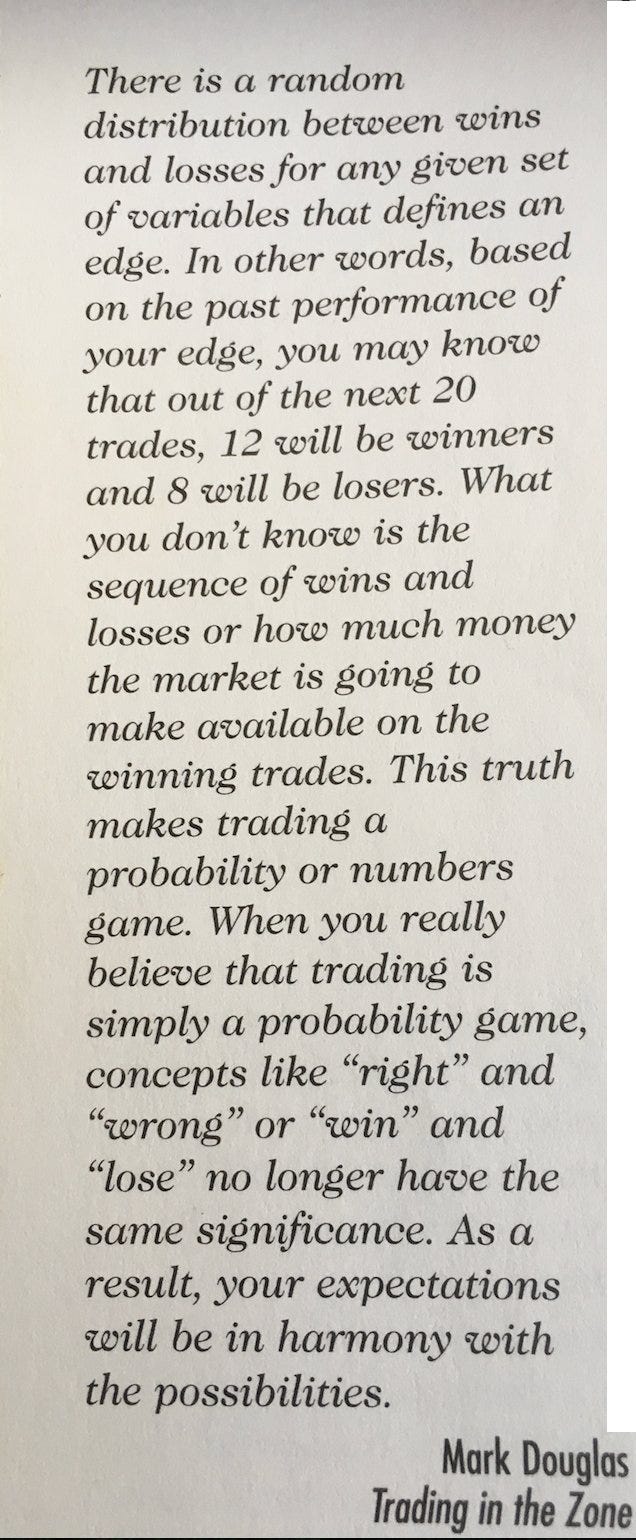

There are a million ways to rationalize trend fighting: seasonality, indicators, put/call ratios, sentiment surveys, election cycles, fundamentals, etc… but the only thing that matters at the end of the day is price action.

I learned the hard way that if you fight trends, the market will win and you will lose. If you made the mistake of buying into a downtrend in 2022, then make it the last year it ever happened.

Individual Stocks:

Did you notice that Apple made a 52-week-low this week? A new 52-week-low is a powerful, objective and indisputable sign of weakness and often a harbinger of things to come.

For instance, Tesla printed a new 52-week-low on October 14th. That’s useful information. How has the stock done since that time?

Besides making a new low, AAPL also happens to look quite problematic on the monthly chart.

Firstly, the monthly candle that just finished forming isn’t great. For the month of December, the stock slid 12.12%, which translates into a big red bar for the month. The bears are in control.

Second, this bearish monthly bar breaks support going back to 2021 and completes a kind of right shoulder of a quasi head & shoulders top.

Bitcoin:

After losing some $2.5 trillion fighting trends this year, you might think that the Crypto community might have learned something, but that doesn’t seem to be the case.

A friend of mine lost half his net-worth this year stubbornly holding Bitcoin. But it’s fine since, as he explains to me, it’s only a loss when you sell. He’s surprised that I’ve been trading for 17 years and didn’t know that.

Even though he’s down $400,000 this year, he doesn’t believe in paying for content and has completely ignored my newsletter. Instead, he cruises around social media and Reddit looking for anything that confirms his view point. One Twitter account he follows has a profile picture of a baby orangutang with laser eyes. Despite the fact that this account has absolutely no strategy or track record, it provides him with the bullish predictions he craves…

Unfortunately for him, these predictions are more likely pipe-dreams as the reality remains that Bitcoin is stuck in a stage 4 downtrend:

So from a Trend Following point of view, there is zero reason to be long Bitcoin at this moment.

Now is it possible that these bullish predictions come true? Yes, it is possible. So let’s imagine that this is the bottom and that the next wave higher takes price to $500,000. How would my strategy deal with that?

The only way Bitcoin goes to $500,000 is by making a series of new 52-week-highs. It’s not going to magically get there overnight. It will trend there over time. And I would be willing to buy the very first new 52-week-high.

This would allow me to profit from $69k to $500k. Granted, you never get in at the bottom, but that would still be one heck of a trend that you could profit from. One weird fact about Trend Following is that you can make a lot of money and never pick a bottom in your entire career.

Performance Review:

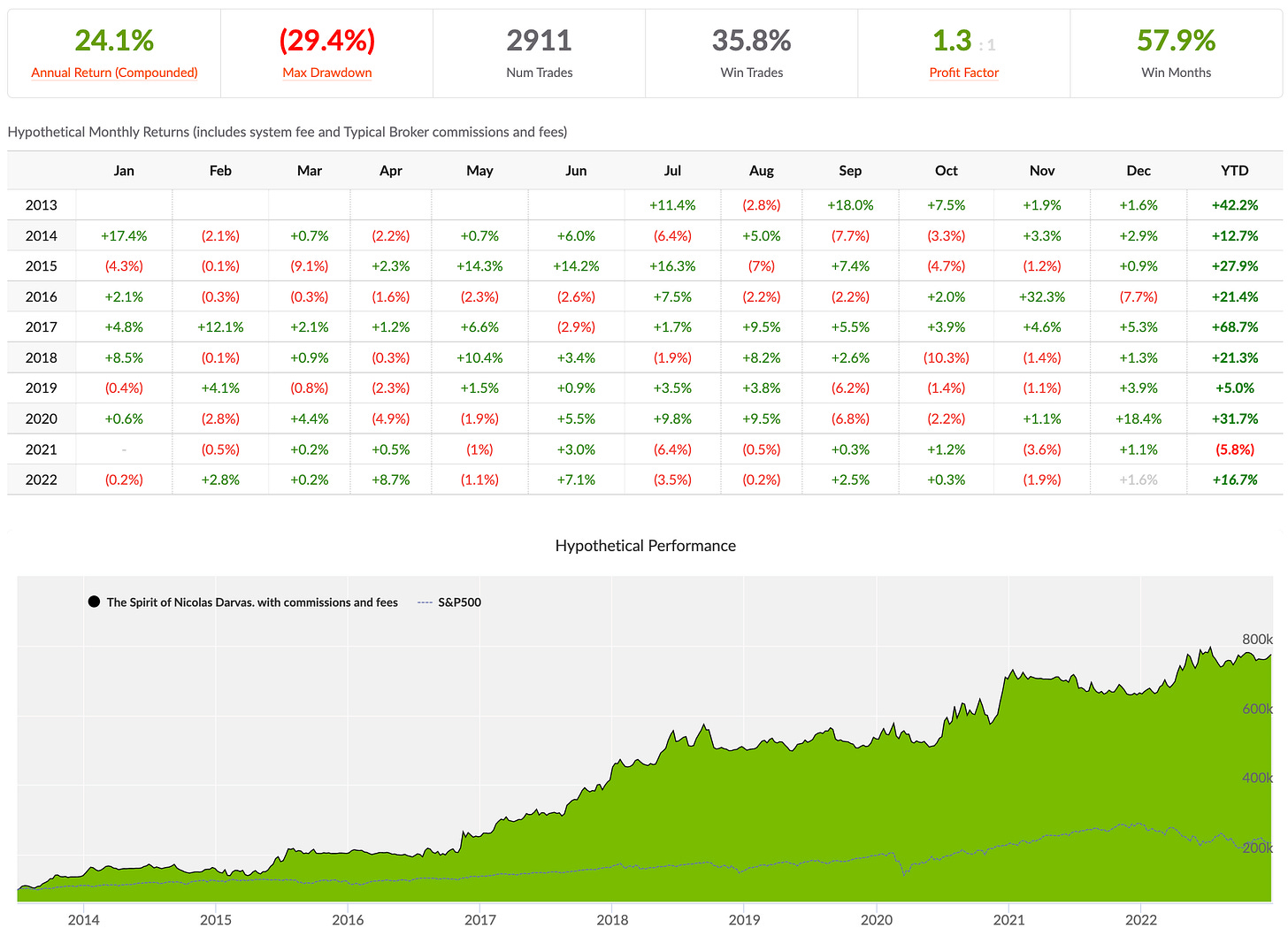

My trading system finished the year with a gain of 16.7%.

A major headwind was that breakout trading just straight up died. I didn’t make a dime buying stocks in 2022.

The only thing that worked was short-selling, but even that remains an incredibly challenging and humbling endeavour.

Overall, though, I’m grateful to have completed year #10 of this real-money track record and for having averaged a 24.1% CAGR during this time.

Danny,

Happy New Year. Lots of wisdom here - hope your bitcoin friend sees the light. Bear markets bring clarity. Have a good week.

Loved this edition. I look forward to it every week. Thank you.