Before we get too far into the new year, I wanted to mention that a beneficial new habit to develop is journaling your trades.

Inspired by the late, great Van K. Tharp, I enter trades into a journal that looks like this:

For example, trade #1 shows an entry price of $10 and - much more importantly - it records your predetermined exit price.

That right there contains the most important piece of advice that I can give to new traders: know where you’re going to get out before you get in.

I remember once coaching a very high net-worth individual and he pointed to his screen and said “I just bought 10,000 shares of AMD, what do you think?”

My response was “okay, that could work, but where will you get out if you’re wrong?”

“What do you mean,” he says “if I thought it was going to go down, I wouldn’t have bought it.”

Well, with AMD dropping 60% last year and without a predetermined exit in place along with such a large position, this is obviously going to result in a highly emotional and painful exit from the stock, most likely when the pain can’t be tolerated any longer.

You want to physically write down your exit price and then simply cut the position and move on if your stop is hit. When that happens, this is known as a 1R loss. You lost what you were willing to risk. In the card game I described (see issue #101), that is akin to receive a face card.

In the second example, with trade #2, your stop is never hit and you exit with a moderate winner that is 3X larger than what you risked. That is known as a 3R winner and is just like receiving a 3 card in the game.

After collecting a large enough sample size, you can begin to determine your average R per trade. Once you have established a positive average R, the outcome of a single trade becomes less important as you realize that it’s just mostly randomness within the context of long-term positive expectancy.

Market Review:

The question that seems to be on everybody’s mind is whether this is a new bull market.

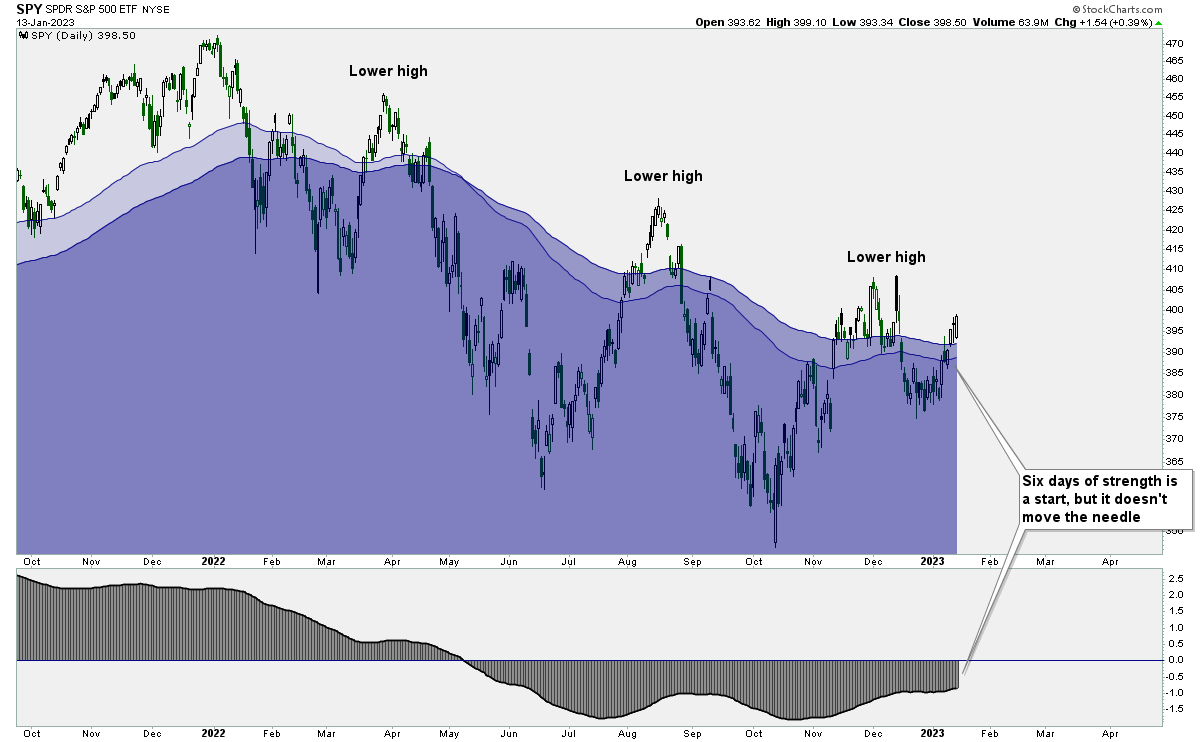

From a purely Trend Following point of view, the S&P 500 is still in a downtrend for the simple reason that price is still forming a series of lower highs:

I know there’s a lot of excitement, almost giddiness, about the prospect of a new bull market, but the reality is that we’ve really only had six days of strength.

Also, even though the chart above is extremely erratic, the long-term trend has been consistently down for months, smoothing out a tremendous amount of short-term noise, including this latest six-day-wonder.

On the plus side, though, price has stopped making new lows, as mentioned last week, showing that bears have lost control. Overall, I’m neutral on the market until more convincing evidence is gathered. That’s probably not very exciting news, but the less exciting your trading is, the more on track you probably are.

Another observation I made this week is that the junkiest, most shorted stocks rallied the most. It was the worst garbage - stocks like GME, BBBY, AMC, and CVNA - that floated to the top.

As I explained in detail in Issue #95, we can create kind of short-squeeze index by dividing MTUM (quality stocks in uptrends) into ARKK (heavily shorted stocks in downtrends).

For the week, ARKK was up by approximately 15%. On the other hand, MTUM didn’t even budge - it was flat for the week.

Therefore, when we divide the charts together, a differential of 15% appears, meaning that this week saw the biggest short-squeeze in years:

The problem with short-covering rallies is that they tend to be quick and unsustainable.

If you think about it, there are only two ways a stock can be bought. The first is when someone, ideally at a large institution, doesn’t own it, but wants to accumulate a position. In this scenario, the investor can buy again and again, creating a sustainable trend.

The second way a stock can be bought is when a short-seller buys back the stock which he didn’t own. Because a short can only be covered once, these type of rallies fizzle out quickly.

For example, I covered my short in Silvergate Capital (more on this later), which made me a buyer of the stock, but I wouldn’t touch it with a ten foot pole by actually accumulating a long position.

The bottom line is that seeing names like Bed Bath & Beyond rally 179% this week is not a positive and suggests a lot of the rally was fuelled by frantic short-covering.

Currencies:

One chart I’ll be keeping an eye on next week is the US Dollar Index. Trends in the USD trickle down to almost every other asset class, so the sharp reversal in the USD has wreaked havoc for classical trend following strategies.

For example, there are three ETFs that track trends - DBMF, KMLM & CTA - and they have all lost their mojo at the exact same time that the US Dollar topped out.

As savage as this pull back has been, though, the greenback could find support as shown below:

This is a monthly chart, so January’s candle isn’t finished forming yet. At this moment, support is being broken, but will the bulls be able to hold support by the end of the month?

Short-Selling:

Before I delve into short-selling, I must reiterate that this is not for everybody and is something that is very challenging.

Also, the last thing I would want to see is a new trader who has been burned by stocks collapsing then try short-selling and get double-burned by a rebound.

That being said, becoming an expert short-seller is a useful skill, especially in a year where stocks go down. For many new traders, the bull market since 2009 conditioned them to think that stocks only go up, but a closer look at history shows many down years:

I would also argue that just looking at the S&P 500 is a kind of hindsight bias. We are retrospectively selecting the most successful country and ignoring dozens of other nations that haven’t done so well, such as Japan, Argentina, Russia, China etc…

But whether you just look at the US or especially if you look more globally, the message is clear: stocks can go down, so why not profit from that reality?