Market Review:

Hello.

Okay, let us now proceed with the analysis of the market.

A persistent theme is that, although last year’s downtrend has ended, what has replaced it isn’t a strong bull-market.

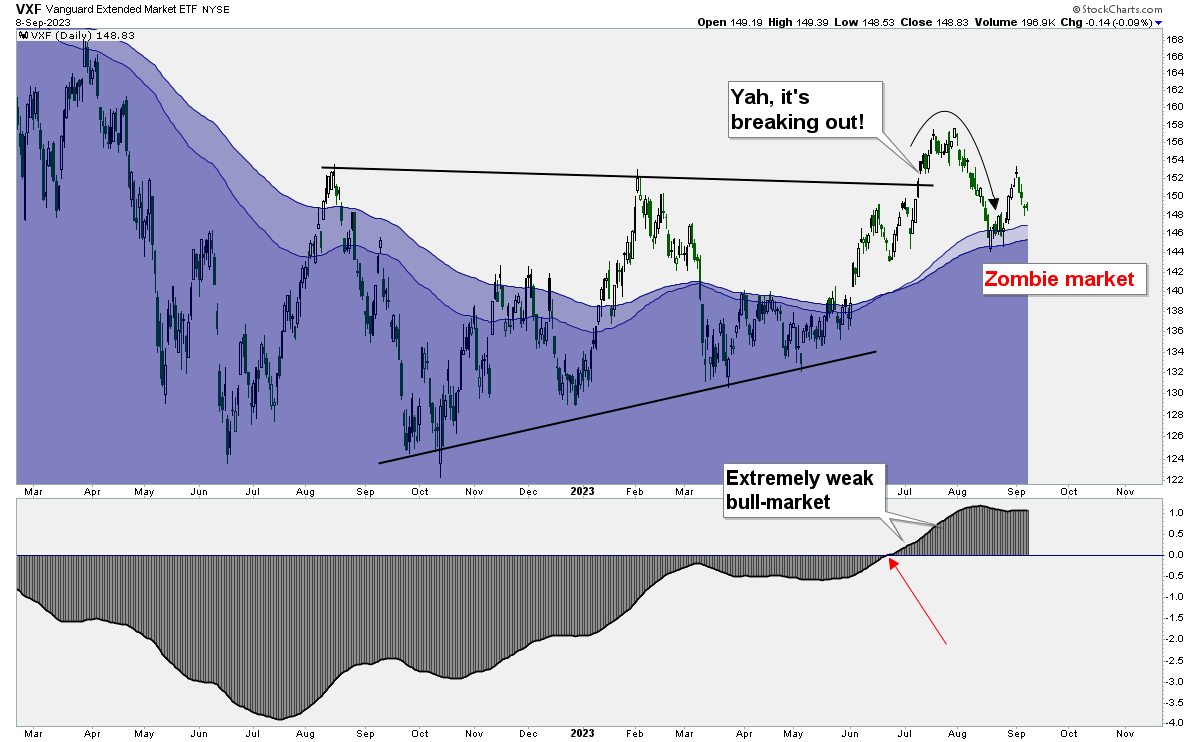

Looking at all stocks in America except those in the S&P 500 (shown below), we can see that the average stock has failed to breakout and is trading at about the same level today as this time last year:

The above chart technically is in an uptrend, but the uptrend is incredibly weak, which could explain why so many breakouts have been failing this year.

Without the help of a handful of big-tech names, there simply is no strong bull market to be seen.

This is especially true if you look at the smallest stocks - Micro-caps.

Trading under the symbol IWC, the iShares Micro-Cap ETF currently appears problematic as this monthly chart shows:

Firstly, there has been close to zero participation in this year’s so-called bull-market. Micro-caps have just been sitting on the sidelines the entire time.

Now this lengthly period of non-participation could simply be setting the stage for a vicious final wave lower.

This scenario is a possibility, which may or may not happen (there are no certainties in the market), however a break below the B channel would increase the odds of this bearish outcome, in which case playing superior defense will be imperative.

Individual Stocks:

Last week, I mentioned that I would be keeping my eye on Apple to determined how it stood up to its gap down.

Fast forward to today, and the outcome couldn’t be clearer.

I never recommended executing this trade, so I can’t take any credit; nonetheless there are some valuable lessons.

First, always beware of gap-downs, or “holes in the wall” since they tend to become resistance later on.

Although the case with AAPL is just a single example, I’ve seen this exact same pattern repeat over and over again.

For example, LCID filled a massive gap down pretty much to the penny and collapsed from that point:

A second lesson regarding the AAPL chart is perhaps the market is losing steam.

In a strong bull-market, a stock should be able to shrug off a gap-down and continue higher.

The fact that AAPL failed so miserably at this important juncture is, in my opinion, a sign of weakness.